client log-in

Observations About Today’s Post-Pandemic Office Market

MARKET OVERVIEW - COMMERCIAL REAL ESTATE OFFICE MARKET OVERVIEW 2022

As the United States emerges from the global health pandemic, the institutional investment office real estate market is at far greater risk than most owners, investors and lenders care to acknowledge. Overall conditions are likely to become much weaker very soon, and it could take several years for a meaningful recovery. In the short term, monetary policy and fiscal policy will trigger a recession, and the demand for office space will drop noticeably. In the long term, demand erosion for office space will be triggered by significant changes in how office occupiers use office facilities, including new “hybrid” workplace strategies.

Recession is coming very soon (if not already here)

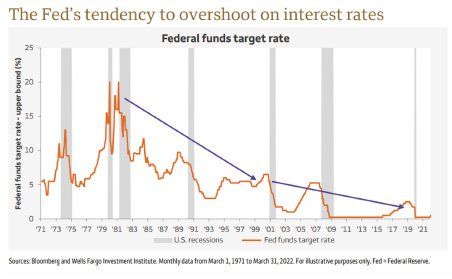

Interest rates have risen dramatically this year and are headed higher -- at levels not experienced since the 1980s. The Federal Reserve may be earnest about its desire to tame inflation -- along with a “soft landing” for the economy -- but the required measures will trigger a deep economic recession. As observed by Sam Zell in a January 2020 interview, deep recessions have been preceded by sharp spikes in interest rates in every instance (except one) over the last 70 years. Moreover, the Fed’s moves along with runaway fiscal policy will get further slammed by an accelerating wave of job layoffs – especially at large tech companies.

Long-term demand destruction by large corporate occupiers of office space is far more pervasive than yet recognized by the real estate industry

Many sizeable corporate office tenants operated surprisingly well during the pandemic with most of their people working from home. Virtually all employers are establishing new “hybrid” workplace occupancy strategies, a combination of “at-work,” at-home” and “at-anywhere.” Some jobs, particularly “back-office/administrative,” may not need traditional office space ever again. This trend will accelerate as lease terms approach upcoming expiration dates and many more occupiers decide – for the first time -- how to renew, relocate, down-size, right-size, or terminate in the wake of new office space utilization patterns and hybrid workplace models. New workplace strategies, of course, vary widely according to industry, company, job activities, and culture—but are just the tail trying to wag the HR dog.

Just how much space is approaching lease expiration?

According to a report by JLL in April this year, 243 million square feet of office leases are set to expire across the country in 2022. This is a 40% increase from 2018. It also represents 11% of all leased office space in the United States (that is only across a certain # of MSA’s…not the entire office marketplace which I have read is 12BB sf). The report also stated that more than 200 million square feet of lease expirations are projected for each of the three following years. So, with roughly 843 million square feet or over 40% of all office leases scheduled to expire in the next three years, it is very likely that there could be substantial reductions (shrinkage?) in occupied space from the existing tenant base – especially in lower quality office assets (Class “A-minus” and below). Green Street Advisors, in The Real Deal (April 12, 2022), estimates a 15 percent decline in office demand. That’s huge. The same article goes on to say, “as companies confront the reality of a hybrid work environment, they’re looking for smaller spaces. That’s bad news for office landlords, who have been able to avoid the worst of the pandemic as they continued to collect rent, regardless of whether or not tenants’ employees were in the office.”

In “Knowledge at Wharton” (February 28, 2022), real estate professor Joseph Gyourko said, “it’s too early to predict exactly how the demand for office space will decline because commercial leases generally last five to seven years. But it’s clear that when those leases finally expire, the market will not be the same . . . . While many companies are calling workers back into the office this year, full occupancy is unlikely. Workers have proven they can function remotely, and they are demanding their employers keep the option of remote or hybrid work.”

Additionally, a study dated May 31, 2022 entitled “Work from Home and Office Real Estate Apocalypse,” by three graduate professors from NYU and Columbia University, predicts a “32% decline in office values in 2020 and 28% in the longer-run, the latter representing a $500 billion value destruction” in New York City alone. The study qualifies this by stating, “Higher quality office building were somewhat buffered against these trends due to a flight to quality, while lower quality office buildings see much more dramatic swings.” In this nascent environment, “quality” might mean something altogether different as experiential distinctions emerge as important to employees.

In an interview with Fortune (June 9, 2022), Stijn Van Nieuwerburgh (Columbia University professor) said, “. . . think of this as a train wreck in slow motion, where essentially only a third of the leases (in New York City) have even come up for renewal.” The article continued by saying, “Very short office leases of one year or less are on the rise, increasing from 15% in 2019 to 26% in 2020 and 32% in 2021, according to Moody Analytics.” The Fortune article goes on to say that, “The implications for investors are huge, as Van Nieuwerburgh argues the lower-grade commercial office buildings could become a ‘stranded asset class’ in the future, and affect how cities raise money.”

Growing List of Troubled Office Assets

One sobering example of what this can do to large office investments comes from a Class “A” 900,000 square foot high-rise office tower in the Northeast. Over ten years ago, more than half of the space was leased to a Fortune 25 company for a regional office. When its employees worked from home during the Pandemic, productivity improved so much that the company has now permanently transferred most of those workers home. This tenant renewed its lease last year for another ten years, but it also reduced its square footage by 65%, from 450,000 to 150,000 square feet. Ten years earlier, this high-rise office tower was purchased by an offshore investor for $120 million. Today, with over 40% of the building vacant, the property is valued at $60 million – far below the existing debt on the asset. How much longer should the owners be willing to meet the underlying debt service?

Blackstone, one of the largest office owners in the world, gave back ownership of an office asset in Manhattan at 1740 Broadway in March 2022 to escape the underlying $308 MM loan (Commercial Observer and The Real Deal March 22, 2022). The loan was on a watchlist for a while soon after L Brands vacated the asset and moved to a much smaller space at 55 Water Street during the Pandemic, two years before its lease expiration. L Brands’ lease for 418,000 square feet (part of a larger 621,000 square foot building) was scheduled to expire at the end of March 2022. Unfortunately, a growing list of troubled office assets are in similar condition. The storm is just beginning.

Naturally, banks and other lenders will inherit more troubled loans as office properties begin underperforming. The Real Deal (April 12, 2022) cited a Barclay’s report in February 2022 showing that 21.2 percent of office loans made after 2008 are now either with special servicers or on watch lists. The number of troubled office loans is at its highest in over a decade. The article also reported that about $1.1 trillion of office building loans are already outstanding, and another $320 billion of loans will mature in the next two years. In an interview with Green Street Advisors on May 18, 2022, Eastdil Secured CEO Mike Van Konynenburg said that “Debt rates are higher than cap rates (for office assets) for the first time since the Global Financial Crisis (2008).”

The demand for more remote work from today’s office workers reduces square footage requirements

Numerous studies show that Millennials, now half of the office workforce in the United States, value “work-life balance” more than anything else in the career world. They are uniquely comfortable with freelance, short-term working contracts instead of long-term traditional career employment. The growing support of work-life balance value by large corporate occupiers means more remote work models and less traditional long-term office space.

JLL’s “Workforce Preferences Barometer” report (June 2, 2022) revealed the extensive demand by office employees for more remote work – away from their company’s traditional office facilities. The report says, “60% of office workers want to work in a hybrid style today, and 55% are doing so already.” Another recent survey showed that over 32% of office workers want to work from home permanently. This has been echoed by several high-profile employers – including AirBnB, Metaverse, Snowflake, and GitLab (which does not have any traditional office space).

Will an employee’s wish for better “work-life balance” suddenly disappear during the forthcoming recession? If there is a big wave of layoffs, large employers will have much more leverage and could insist that their remaining employees return to the office – at least for a few days per week. Elon Musk’s dramatic e-mail ultimatum in June required all employees to return to the office for a minimum of 40 hours per week. That might seem extreme, but still, might be the best solution for Tesla – particularly as a manufacturing-oriented company. Extreme or not, it reflects what many other office employers are thinking. Google, for example, recently shared an internal study that showed programming errors increased 40% during the time that many of its employees were using remote work models. The brightest companies will figure out the optimal model for their respective enterprise and, in most cases, will include a growing portion of permanent remote work. The long-term use of traditional office space is already changing, and it is remarkable to see how much capital some Big Tech office occupiers (particularly Microsoft, Amazon, Facebook and Google) are investing in changing that use. The next generation of “right-sizing” is extremely complicated, but if designed correctly, it will produce significantly better productivity and financial performance for office occupiers.

Is there any good news?

It may take a little time, but deep recessions eventually deliver new investment opportunities for poised investors at extraordinary value.

As just one example, consider the remarkable history of the office real estate market in Austin, Texas. During the S&L Crisis in 1987, Austin’s office vacancy rate hit 40%. As shocking as that was, that market recovered in a remarkably short period of time. Within 5 years, by 1992, office vacancy dipped below 15%. Within 10 years, by 1997, vacancy dropped and remained below 10%; by early 2000, the overall vacancy rate was less than 3%. All of this occurred within 15 years. Many other office markets in the United States experienced similar swings in vacancy rates and created some new breathtaking investment opportunities.

Today, Austin’s vacancy rate (including sublease space) is 15.4% -- just under the national vacancy rate of 15.7%. With today’s bigger economic headwinds, Austin’s office market will soften again somewhat, but probably not nearly as severely as in 1987. Still, there is over 11 million square feet of new office space under construction in that market today – leading the nation in new construction as-a-percentage-of-existing-inventory at 11%. Will Austin, and other high-profile, tech-oriented office markets, revert to the long-term historic cycle of single-digit -vacancy rates or will some of its new oversupply (primarily lowerclass office assets) actually never recover —triggering a wave of re-development conversions to other asset uses?

Conclusion

There will be plenty of pain for office markets in the next few years, but experience shows that these conditions will also produce spectacular new investment opportunities. Those new opportunities, however, will be much more selective and much closer aligned with the new office facility utilization patterns and occupancy paradigms required by corporate occupiers. There will be more focus on experiential work environments, more places for office employees to do their work, and more attention to hybrid occupancy solutions that improve hiring and retaining the best talent—all these things will serve to bring the demand side and supply side in good alignment again for a very interesting future.

__________________________________________________________________________________________________________________________________________________

Sources

1) Bloomberg and Wells Fargo Investment Institute March 1,1971-March 31, 2022

2) Tim Ferriss Show Podcast “Interview with Sam Zell” (January 23, 2020)

3) Federal Reserve Bank of Dallas “Southwest Economy” (March/April 2005)

4) CBRE US Office Report (Q3 2019)

5) Commercial Edge National Office Report (March 2022)

6) Commercial Edge National Office Report (May 2022)

7) The Real Deal (March 22, 2022)

8) The Real Deal (April 12, 2022)

9) The Commercial Observer (March 22, 2022)

10) JLL Research (April 2022)

11) JLL Workforce Preferences Barometer (June 2, 2022)

12) Forbes (November 2020)

13) CNBC (January 2021)

14) Green Street Advisers Webinar (May 18, 2022)

15) Knowledge at Wharton (February 2022)

16) Work From Home and the Office Real Estate Apocalypse (May 31, 2022)

About the Author

Jim Suber is a principal at Strategic Real Estate Advisory, Inc. He has over 35 years of experience with large corporate occupiers throughout North America, including corporate services, strategic planning, portfolio management, project management, brokerage, and development.

213 566 2464

WEST LOS ANGELES | ORANGE COUNTY | SAN DIEGO | SAN FRANCISCO

MAIN OFFICE

16921 Via de Santa Fe, Suite C, Box 5005

Rancho Santa Fe, CA 92067

Jeffrey V. Langdon, Broker CAL BRE#00793022